THE EFFECT OF STRUCTURAL BREAKS IN MODELING THE RELATIONSHIP BETWEEN MONETARY POLICY AND ECONOMIC GROWTH IN NIGERIA: AN APPLICATION OF THE ARDL

DOI:

https://doi.org/10.60787/tnamp-19-231-244Keywords:

Monetary Policy, Economic Growth, Structural breakAbstract

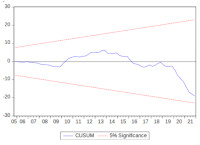

Monetary policy is the key in sustainable economic growth and this has spurred many empirical studies in econometrics. The aim of this study is to investigate if the behavioural tendency of ARDL when the data is contaminated with structural breaks. Studies have shown that Nigerian macroeconomic variables exhibit hostile volatility and in literature, most works readily accessible do not consider structural breaks in their application of ARDL. This study seeks to find out whether structural breaks matter in the application of ARDL especially in its application in the evaluation of economic growth due to monetary variable shocks. The Zivot-Andrew’s unit root test that accounts for structural break is employed, the paper will compare the unit root result with the conventional ADF result, while the Autoregressive Distributed Lag (ARDL) bounds testing approach is used to investigate the co-integration among the variables of interest troubled with structural breaks and uncontrollable volatility. Our finding shows that researchers working with macroeconomic time series data in the contest of countries like Nigeria are advised not to use only unit root test such as ADF, DF-GLS, and PP that do not account for structural breaks but should employ unit root test that account for structural changes/breaks, such as Zivot Andrews test, the Chow test and Bai Perron multiple structural break test.

Downloads

References

CBN (2011). “What is Monetary Policy?” Understanding Monetary Series No. 1. Jinghan, M.L. (2004). Acroeconomic Theory, 10th Revised & Enlarged Edition (Vrinda Publications (P) Ltd,), p. 99. Okafor, P. N. (2009). “Monetary Policy Framework in Nigeria: Issues and Challenges,” CBNEconomic and Financial Review, 33(2).

Henry, E.A and Sabo, A.M.(2020).Impact of monetary policy on inflation rate in Nigeria: Vector Autoregressive Analysis, Bullion. 44(4),6. https://dc.cbn.gov.ng/bullion/vol44/iss4/6 13.

Kayode O. B, Israel O. U.and Onyuka F. M.(2020). The impacts of monetary policies on savings and investment in developing economies: A case study. halid: hal-02520027 https://hal.archivesouvertes.fr/hal-02520027 Preprint submitted on 26 Mar 2020 15.

Abiodun S. O. and Ogun, T.P.(2019). Asymmetric effect of monetary policy shocks on output and prices in Nigeria. African Journal of Economic Review,7(1), 238-248.

Ajibola, A and Oluwole, A. (2018). Impact of monetary policy on economic growth in Nigeria. Open access library journal, 5( e4320): ISSN print: 2333-9705, ISSN online: 2333-9721.

Okoro, A. S. (2018). Impact of Monetary Policy on Nigeria Economic Growth. Prime Journal of Social Sciences. 2 (2), 195-199.

Osondu , A.N, and Adiele, D.F (2021), “Evaluating the impact of some macroeconomic determinants on economic growth in Nigeria using the autoregressive distributed lag (ARDL) model. COOU journal of physical sciences, 4(1), 191-201.

Chipote, P and Makhetha-Kosi, P.(2014). Impact of monetary policy on economic growth: A case study of South Africa. Mediterranean journal of social sciences, MCSER publishing, Rome-Italy.5(15):76-84. ISSN 2039-9340(Print) ISSN 2039-2117(Online)

Micheal, B. and Ebibai,T.S.(2014). Monetary policy and economic growth in Nigeria (1980-2011). Asia Economic and Financial Review, Vol.4(1). Pp.20-32

Zivot, E. and Andrews, K. (1992). Further evidence on the great crash, the oil price shock, and the unit root hypothesis. Journal of Business and Economic Statistics, 10 (10), 251- 270.

Perron, P. (1989) Trend, unit root and structural change in macroeconomic time series. In Cointegration for the Applied Economist, Rao, B.B. (ed) MacMilian Press: Basingstoke, pp. 113-146

Downloads

Published

Issue

Section

License

Copyright (c) 2024 The Transactions of the Nigerian Association of Mathematical Physics

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.